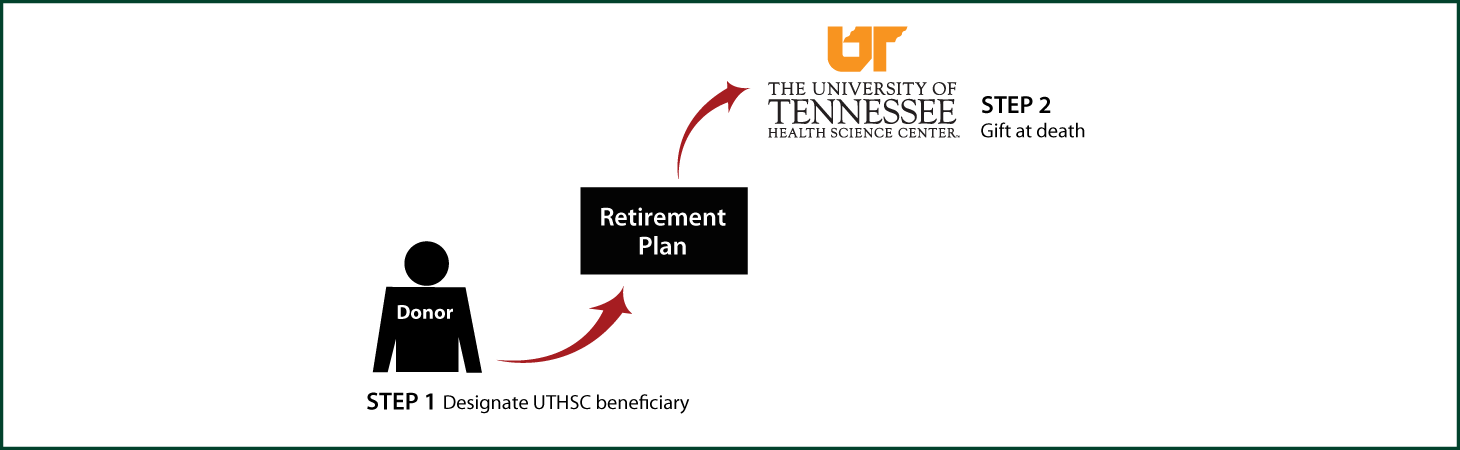

Gifts from Retirement Plans at Death

How It Works

- You name UTHSC as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to UTHSC

- No federal estate tax on the funds

- You make a significant gift for the programs you support at UTHSC

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Bethany K. Goolsby, JD

Associate Vice Chancellor for Development

(901) 448-8212

bgoolsby@uthsc.edu

The University of Tennessee

Health Science Center

62 S. Dunlap, Suite 500

Memphis, TN 38163

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer