Closely Held Business Stock

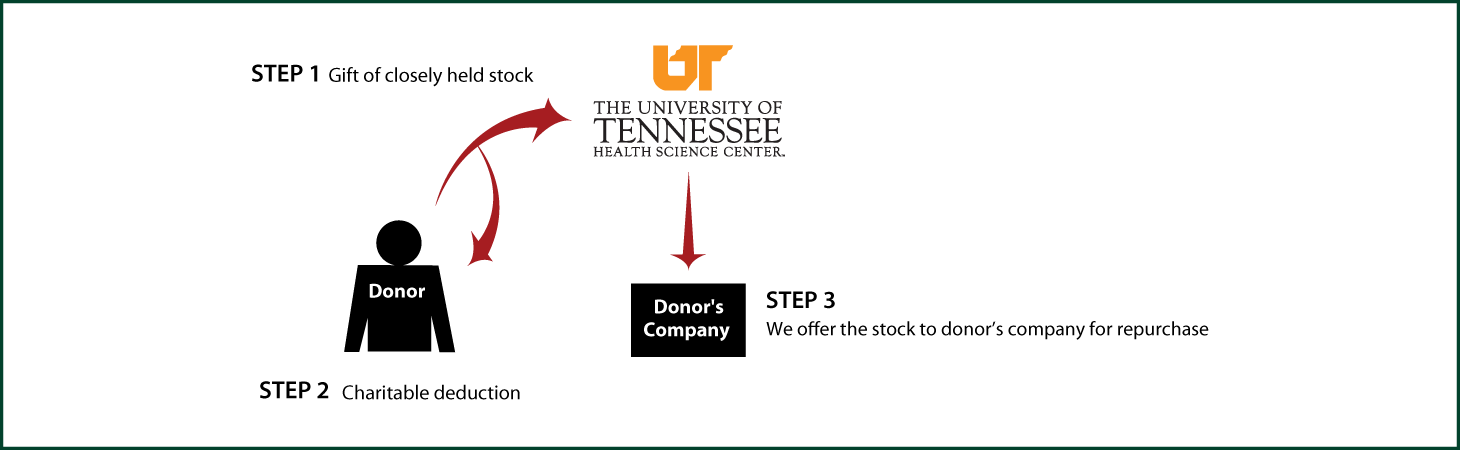

How It Works

- You make a gift of your closely held stock to UTHSC and get a qualified appraisal to determine its value

- You receive a charitable income-tax deduction for the full fair-market value of the stock

- UTHSC may keep the stock or offer to sell it back to your company

Benefits

- You receive an income-tax deduction for the fair-market value of stock

- You pay no capital-gain tax on any appreciation

- Your company may repurchase the stock, thereby keeping your ownership interest intact

- UTHSC receives a significant gift

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Bethany K. Goolsby, JD

Associate Vice Chancellor for Development

(901) 448-8212

bgoolsby@uthsc.edu

The University of Tennessee

Health Science Center

62 S. Dunlap, Suite 500

Memphis, TN 38163

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer